"Maximizing Your Financial Future: Understanding Home Loans and Investment Banks in Rhode Island"

#### Home LoanA home loan, often referred to as a mortgage, is a type of loan specifically used to purchase real estate. It allows individuals to buy a home……

#### Home Loan

A home loan, often referred to as a mortgage, is a type of loan specifically used to purchase real estate. It allows individuals to buy a home without having to pay the entire purchase price upfront. Instead, the borrower agrees to repay the loan amount, plus interest, over a specified period, typically 15 to 30 years. Home loans can come in various forms, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA and VA loans.

When considering a home loan, it's essential to evaluate your financial situation, credit score, and the current market conditions. Lenders will assess your ability to repay the loan based on these factors. A higher credit score generally leads to better interest rates, which can save you thousands of dollars over the life of the loan. Additionally, understanding the different types of home loans available can help you choose the best option for your financial goals.

#### Investment Bank

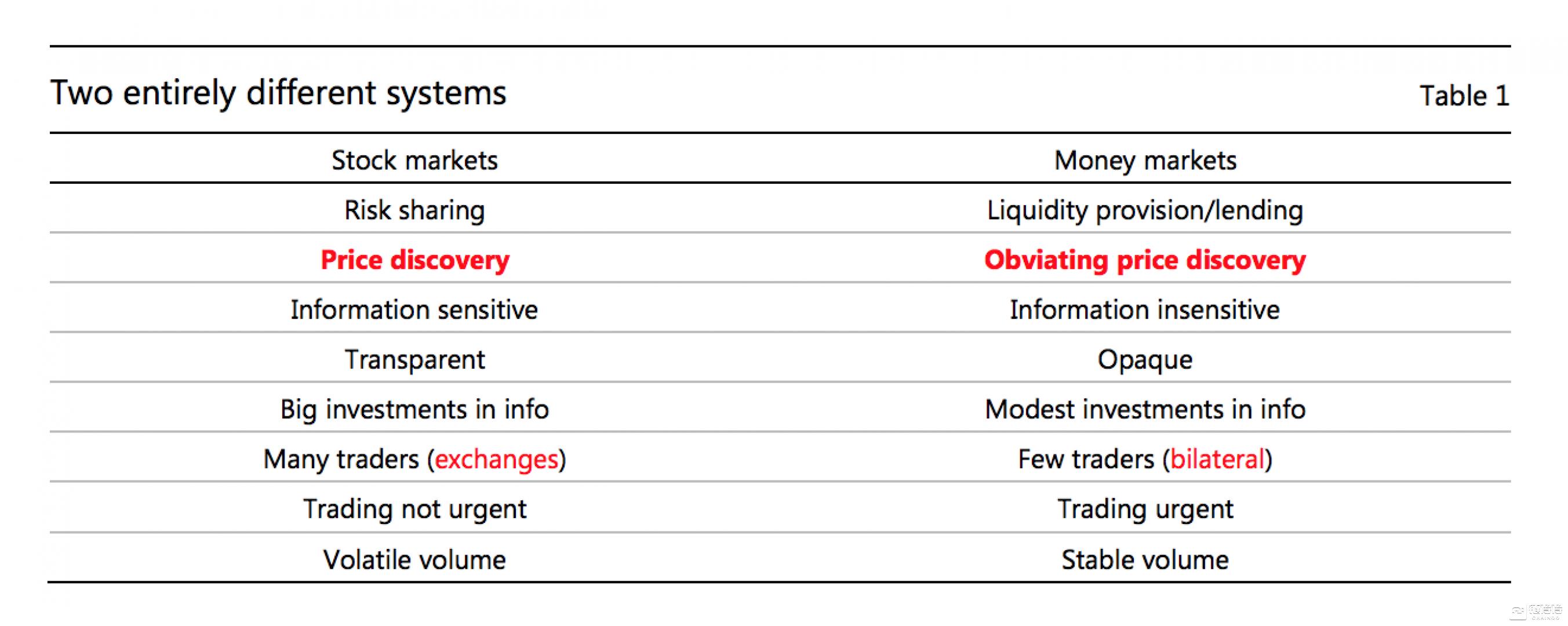

An investment bank is a financial institution that assists individuals, corporations, and governments in raising capital by underwriting and issuing securities. Investment banks also provide advisory services for mergers and acquisitions, market-making, and trading of derivatives. Unlike traditional banks that focus on deposits and loans, investment banks primarily deal with large-scale financial transactions and capital markets.

In Rhode Island, investment banks play a crucial role in the local economy by facilitating business growth and investment opportunities. They help businesses navigate complex financial landscapes and provide expertise in structuring deals that can lead to significant financial gains. For individuals looking to invest in real estate or other ventures, partnering with an investment bank can provide valuable insights and access to capital.

#### Home Loan and Investment Bank RI

In Rhode Island, the relationship between home loans and investment banks is vital for those looking to purchase property or invest in real estate. Investment banks in RI can assist potential homeowners in understanding the mortgage market, providing guidance on securing favorable home loan terms. They can also help investors identify lucrative opportunities in the real estate market, whether it be residential properties or commercial ventures.

For first-time homebuyers, navigating the complexities of home loans can be daunting. However, investment banks can offer tailored advice and financial products that meet the unique needs of individuals in Rhode Island. By leveraging their expertise, buyers can make informed decisions that align with their long-term financial objectives.

Moreover, investment banks can facilitate connections with local lenders who specialize in home loans, ensuring that buyers have access to a wide range of financing options. This is particularly important in a competitive housing market, where having the right financing can make all the difference in securing a property.

In summary, understanding the interplay between home loans and investment banks in Rhode Island is essential for anyone looking to invest in real estate or purchase a home. By leveraging the expertise of investment banks, individuals can navigate the complexities of the financial landscape, secure favorable loan terms, and ultimately achieve their financial goals. Whether you are a first-time homebuyer or an experienced investor, the right guidance can lead to a successful and rewarding financial future.