Understanding Equity Loans Rate: How to Secure the Best Deal for Your Home Equity Loan

#### What is Equity Loans Rate?Equity loans rate refers to the interest rate applied to home equity loans, which allow homeowners to borrow against the equi……

#### What is Equity Loans Rate?

Equity loans rate refers to the interest rate applied to home equity loans, which allow homeowners to borrow against the equity they have built in their property. This rate can significantly impact the overall cost of the loan and the monthly payments, making it crucial for borrowers to understand how it works and what factors influence it.

#### Factors Affecting Equity Loans Rate

Several factors can affect the equity loans rate, including:

1. **Credit Score**: Lenders typically offer lower rates to borrowers with higher credit scores. A strong credit history indicates to lenders that the borrower is less of a risk.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of the home. A lower LTV often results in a better equity loans rate, as it suggests that the borrower has more equity in their home.

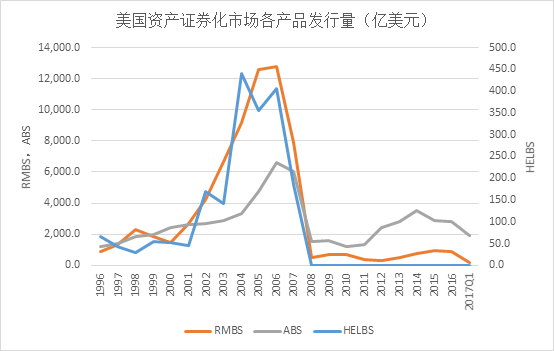

3. **Market Conditions**: Economic factors, such as inflation rates and the overall health of the housing market, can influence interest rates. When the economy is strong, rates may rise, while they tend to decrease during economic downturns.

4. **Loan Type**: There are different types of equity loans, including fixed-rate and adjustable-rate loans. Fixed-rate loans maintain the same interest rate throughout the life of the loan, while adjustable-rate loans can fluctuate based on market conditions.

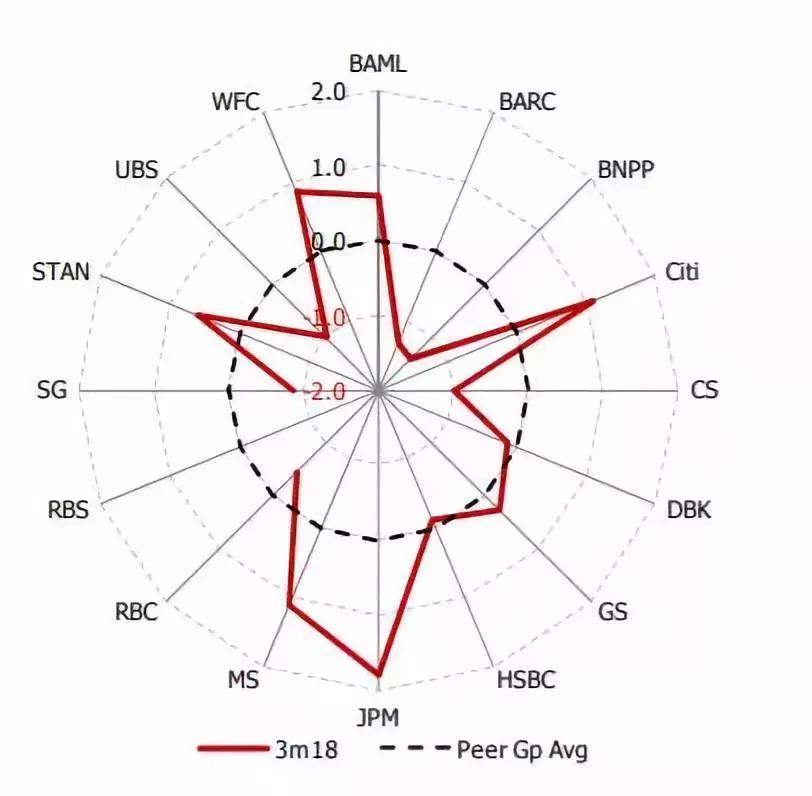

5. **Lender Policies**: Different lenders have varying criteria and policies that can affect the equity loans rate. It’s important for borrowers to shop around and compare offers from multiple lenders to find the best rate.

#### How to Secure the Best Equity Loans Rate

To secure the best equity loans rate, borrowers should consider the following steps:

1. **Improve Your Credit Score**: Before applying for a home equity loan, take steps to improve your credit score. This may include paying down existing debts, making timely payments, and checking your credit report for errors.

2. **Increase Your Home’s Value**: If possible, make improvements to your home to increase its value. This can help improve your LTV ratio and potentially lead to a better equity loans rate.

3. **Shop Around**: Don’t settle for the first offer you receive. Contact multiple lenders, including banks, credit unions, and online lenders, to compare rates and terms.

4. **Consider Timing**: Interest rates can fluctuate based on market conditions. Keep an eye on economic news and consider applying for a loan when rates are lower.

5. **Negotiate**: Don’t hesitate to negotiate with lenders. If you have received a better offer from another lender, let your preferred lender know. They may be willing to match or beat the offer to secure your business.

#### Conclusion

Understanding equity loans rate is essential for homeowners looking to leverage their home’s equity for financial needs. By considering the factors that influence rates and taking proactive steps to secure the best deal, borrowers can make informed decisions that align with their financial goals. Whether you’re looking to consolidate debt, fund home improvements, or cover unexpected expenses, a home equity loan can be a valuable tool when approached with knowledge and care.