How Do I Take a Loan from My 401k? A Step-by-Step Guide to Accessing Your Retirement Funds

Guide or Summary:Understanding 401k LoansEligibility for a 401k LoanThe Application ProcessRepayment TermsTax Implications and RisksAlternatives to 401k Loa……

Guide or Summary:

- Understanding 401k Loans

- Eligibility for a 401k Loan

- The Application Process

- Repayment Terms

- Tax Implications and Risks

- Alternatives to 401k Loans

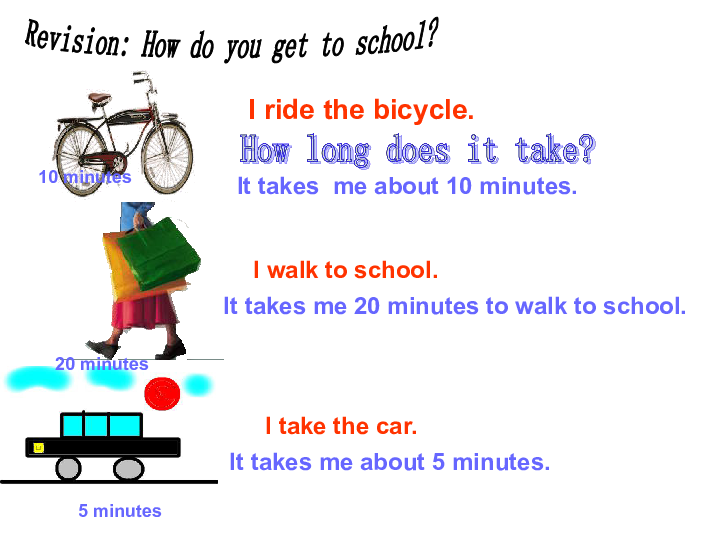

#### Translation of "how do i take a loan from my 401k": How do I take a loan from my 401k?

Understanding 401k Loans

Taking a loan from your 401k can be an attractive option if you need quick access to cash. However, it’s essential to understand how this process works and the implications it may have on your retirement savings. A 401k loan allows you to borrow against your retirement savings, which means you are essentially borrowing your own money. This can be a viable solution for emergencies, major expenses, or investments, but it’s crucial to approach it with caution.

Eligibility for a 401k Loan

Before you can take a loan from your 401k, you need to determine if your plan allows it. Not all 401k plans offer loan provisions, so review your plan documents or contact your plan administrator for details. Generally, you must be an active employee and have a vested balance in your 401k account to qualify for a loan. The IRS allows you to borrow up to 50% of your vested balance or a maximum of $50,000, whichever is less.

The Application Process

Once you confirm your eligibility, the next step is to apply for the loan. This process typically involves filling out a loan application form provided by your plan administrator. You will need to specify the amount you wish to borrow and the purpose of the loan. Be prepared to provide any necessary documentation that supports your request.

Repayment Terms

When you take a loan from your 401k, you are required to repay it, usually within five years, although longer terms may be available if the loan is used to purchase a primary residence. Repayments are typically made through payroll deductions, and you will pay interest on the loan. The interest rates are often lower than those of personal loans, and the interest you pay goes back into your 401k account.

Tax Implications and Risks

While taking a loan from your 401k may seem straightforward, it’s important to consider the tax implications and risks involved. If you fail to repay the loan according to the agreed-upon terms, it may be treated as a distribution, which could result in taxes and penalties. Additionally, borrowing from your retirement savings can hinder your long-term growth potential. You miss out on compound interest that could have accumulated during the loan period.

Alternatives to 401k Loans

If borrowing from your 401k doesn’t seem like the best option for you, consider alternatives such as personal loans, home equity loans, or even credit cards for smaller expenses. Each option comes with its own set of pros and cons, so evaluate your financial situation carefully before making a decision.

In summary, taking a loan from your 401k can provide quick access to funds when you need them the most. However, it’s essential to understand the eligibility requirements, application process, repayment terms, and potential risks involved. Always consider your long-term financial goals and explore alternatives before deciding to borrow from your retirement savings. If you still have questions, consulting with a financial advisor can provide personalized guidance tailored to your situation.