Understanding Home Equity Loan Rates in Austin: What You Need to Know

#### Home Equity Loan Rates AustinHome equity loans have become a popular financial option for many homeowners in Austin, Texas. As the real estate market c……

#### Home Equity Loan Rates Austin

Home equity loans have become a popular financial option for many homeowners in Austin, Texas. As the real estate market continues to thrive, understanding the intricacies of home equity loan rates in Austin is vital for homeowners looking to leverage their property’s value. This guide will delve into what home equity loans are, how rates are determined, and what Austin residents can expect in the current market.

#### What is a Home Equity Loan?

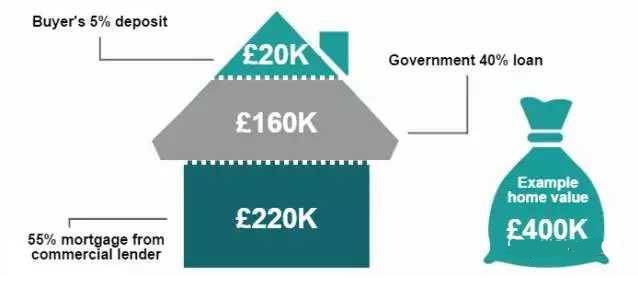

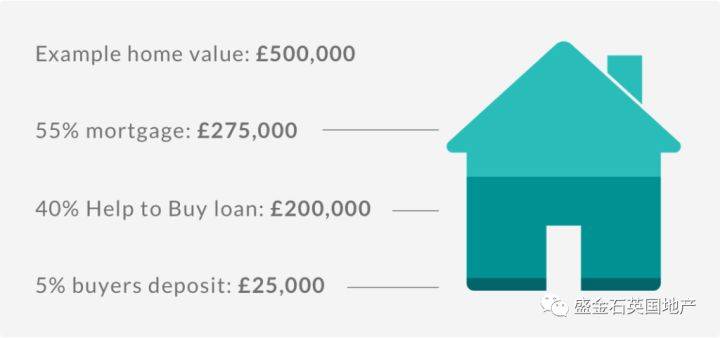

A home equity loan allows homeowners to borrow against the equity in their homes. Equity is the difference between the market value of the home and the outstanding mortgage balance. Homeowners can access this equity as a lump sum, which can be used for various purposes, such as home improvements, debt consolidation, or funding major expenses.

#### Factors Influencing Home Equity Loan Rates in Austin

The rates for home equity loans in Austin can vary significantly based on several factors:

1. **Credit Score**: Lenders assess the borrower's creditworthiness. A higher credit score typically results in lower interest rates, as it indicates a lower risk for the lender.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of the home. A lower LTV can help secure better rates, as it signifies that the borrower has more equity in their home.

3. **Market Conditions**: Economic factors, such as the Federal Reserve's interest rates and the overall housing market in Austin, can influence home equity loan rates. Keeping an eye on these trends can help borrowers make informed decisions.

4. **Loan Amount and Term**: The amount borrowed and the loan term can also affect the interest rate. Generally, shorter-term loans come with lower rates compared to longer-term loans.

#### Current Trends in Home Equity Loan Rates in Austin

As of 2023, home equity loan rates in Austin have shown a mix of stability and fluctuation, influenced by the broader economic environment. With Austin's housing market remaining robust, many homeowners are exploring home equity loans as a viable financial option. It's essential for potential borrowers to shop around and compare rates from different lenders to find the best deal.

#### Tips for Securing the Best Home Equity Loan Rates in Austin

1. **Improve Your Credit Score**: Before applying for a home equity loan, check your credit report and take steps to improve your score if necessary. Paying down debts and ensuring timely payments can boost your creditworthiness.

2. **Shop Around**: Don’t settle for the first offer. Different lenders may provide varying rates and terms. It’s beneficial to compare multiple offers to find the most favorable conditions.

3. **Consider Local Lenders**: Local banks and credit unions in Austin may offer competitive rates and personalized service. Establishing a relationship with a local lender can sometimes lead to better terms.

4. **Understand the Fees**: Be aware of any closing costs or fees associated with the loan. These can impact the overall cost of borrowing, so it's essential to factor them into your decision.

#### Conclusion

Navigating the landscape of home equity loan rates in Austin can be daunting, but with the right knowledge and preparation, homeowners can make informed decisions that benefit their financial future. Whether it's for renovations, consolidating debt, or funding education, understanding how to leverage home equity effectively is key. Always consider consulting with a financial advisor or mortgage specialist to ensure you are making the best choice for your unique situation.