"Step-by-Step Guide on How to Apply for Home Loan Pre Approval: Your Key to a Smooth Home Buying Process"

#### What is Home Loan Pre Approval?Home loan pre approval is a crucial step in the home buying process. It involves a lender reviewing your financial situa……

#### What is Home Loan Pre Approval?

Home loan pre approval is a crucial step in the home buying process. It involves a lender reviewing your financial situation to determine how much money they are willing to lend you for a mortgage. This process provides you with a clear understanding of your budget, making it easier to shop for homes within your price range.

#### Why Should You Apply for Home Loan Pre Approval?

Applying for home loan pre approval offers several benefits. First, it gives you a competitive edge in the housing market. Sellers often prefer buyers who have been pre-approved, as it indicates that you are a serious buyer with the financial backing to make a purchase. Second, it saves you time by narrowing down your home search to properties that fit your budget. Lastly, pre approval can expedite the loan process once you find a home you want to buy, as much of the paperwork will already be completed.

#### How to Apply for Home Loan Pre Approval

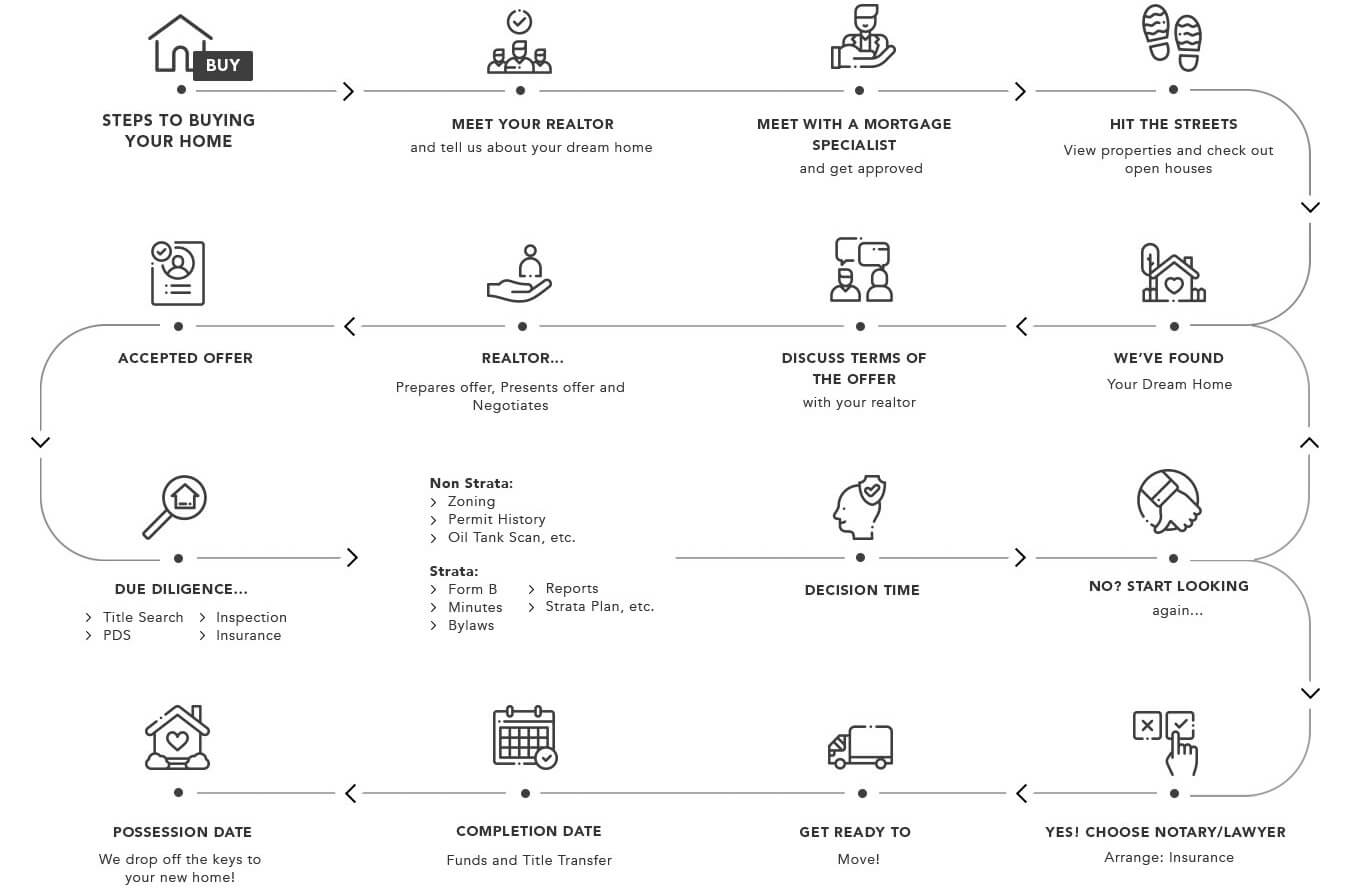

Applying for home loan pre approval can seem daunting, but it can be broken down into manageable steps:

1. **Check Your Credit Score**: Before you apply for home loan pre approval, check your credit score. A higher score can help you secure better loan terms. If your score is lower than you’d like, consider taking steps to improve it before applying.

2. **Gather Financial Documents**: Lenders will require various documents to assess your financial situation. This typically includes your income statements, tax returns, bank statements, and details about any debts you may have. Being organized can speed up the pre approval process.

3. **Research Lenders**: Not all lenders offer the same terms and rates. Take the time to research different lenders and their offerings. Look for reviews and testimonials to find a lender that suits your needs.

4. **Complete the Application**: Once you’ve chosen a lender, you can complete the application for home loan pre approval. This can often be done online, and you’ll need to provide the financial documents you gathered earlier.

5. **Wait for the Decision**: After submitting your application, the lender will review your financial information and credit history. This process can take anywhere from a few hours to a few days. Once approved, you’ll receive a pre approval letter outlining how much you can borrow.

6. **Stay in Touch with Your Lender**: Even after receiving pre approval, it’s important to maintain communication with your lender. Any significant changes in your financial situation may affect your pre approval status.

#### Conclusion

In conclusion, applying for home loan pre approval is a vital step in your home buying journey. It not only empowers you with knowledge about your budget but also enhances your position as a buyer in a competitive market. By following the steps outlined above, you can navigate the pre approval process with confidence and take a significant step towards owning your dream home. Remember, being prepared and informed is key to a successful home buying experience.