Top FHA Loan Providers: Your Guide to Finding the Best Options

Guide or Summary:What Are FHA Loans?Why Choose FHA Loan Providers?How to Choose the Right FHA Loan ProviderTop FHA Loan Providers to ConsiderWhen it comes t……

Guide or Summary:

- What Are FHA Loans?

- Why Choose FHA Loan Providers?

- How to Choose the Right FHA Loan Provider

- Top FHA Loan Providers to Consider

When it comes to purchasing a home, understanding your financing options is crucial. One of the most popular choices for first-time homebuyers and those with less-than-perfect credit is the FHA loan. FHA loan providers play a significant role in making homeownership accessible to a broader audience. In this article, we will explore the top FHA loan providers, what they offer, and how to choose the right one for your needs.

What Are FHA Loans?

FHA loans are government-backed mortgages designed to help individuals and families achieve homeownership. The Federal Housing Administration (FHA) insures these loans, which reduces the risk for lenders and allows them to offer more favorable terms to borrowers. Typically, FHA loans require a lower down payment—often as low as 3.5%—and have more lenient credit score requirements compared to conventional loans.

Why Choose FHA Loan Providers?

FHA loan providers specialize in offering these government-backed loans, making them a great resource for homebuyers looking for affordable financing options. Here are some reasons to consider working with FHA loan providers:

1. **Lower Down Payments**: FHA loans allow for down payments as low as 3.5%, making it easier for buyers to enter the housing market.

2. **Flexible Credit Requirements**: FHA loan providers typically have more flexible credit score requirements, which can benefit those with lower credit scores.

3. **Competitive Interest Rates**: Because these loans are insured by the government, FHA loan providers can often offer competitive interest rates.

4. **Assistance Programs**: Many FHA loan providers offer additional assistance programs, such as down payment assistance or homebuyer education courses.

How to Choose the Right FHA Loan Provider

When selecting an FHA loan provider, consider the following factors:

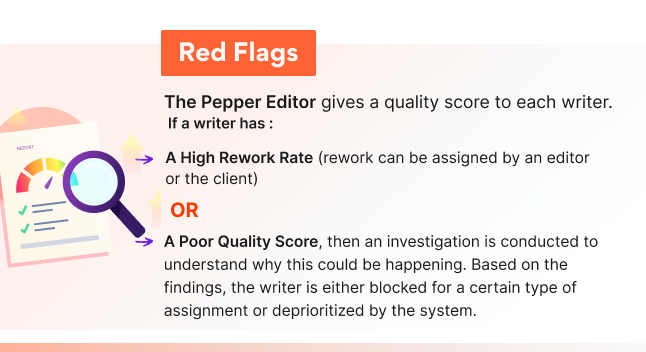

1. **Reputation and Experience**: Research the provider’s reputation in the market. Look for reviews, testimonials, and ratings from previous clients.

2. **Loan Options**: Ensure the provider offers a variety of loan options to meet your specific needs, including fixed-rate and adjustable-rate mortgages.

3. **Customer Service**: A responsive and knowledgeable customer service team can make the loan process smoother and less stressful.

4. **Fees and Closing Costs**: Compare the fees and closing costs associated with different FHA loan providers to find the most cost-effective option.

Top FHA Loan Providers to Consider

While there are many FHA loan providers in the market, some of the most reputable ones include:

1. **Quicken Loans**: Known for its user-friendly online platform and excellent customer service, Quicken Loans is a popular choice for FHA loans.

2. **Wells Fargo**: With a long-standing history in the mortgage industry, Wells Fargo offers a range of FHA loan options and has a strong customer service reputation.

3. **US Bank**: US Bank provides a variety of FHA loan products and has a dedicated team to assist borrowers through the process.

4. **LoanDepot**: This provider is known for its fast approval process and competitive rates, making it a great option for those looking to close quickly.

Choosing the right FHA loan provider can make a significant difference in your home-buying experience. By understanding what FHA loans are, why they are beneficial, and how to select a provider, you can take the first step toward homeownership with confidence. Whether you are a first-time buyer or looking to refinance, exploring your options with reputable FHA loan providers will help you find the best financing solution for your needs.