"Navigating Financial Recovery: Your Guide to Loans After Bankruptcy"

Guide or Summary:Understanding BankruptcyRebuilding Your Credit After BankruptcyTypes of Loans AvailableTips for Securing Loans After Bankruptcy**Loans Afte……

Guide or Summary:

- Understanding Bankruptcy

- Rebuilding Your Credit After Bankruptcy

- Types of Loans Available

- Tips for Securing Loans After Bankruptcy

**Loans After Bankruptcy** (破产后的贷款)

The journey of financial recovery after bankruptcy can be daunting, but understanding your options for **loans after bankruptcy** can pave the way to rebuilding your financial stability. Bankruptcy is often seen as a financial dead end, but it can also serve as a fresh start, allowing individuals to learn from past mistakes and regain control over their finances.

Understanding Bankruptcy

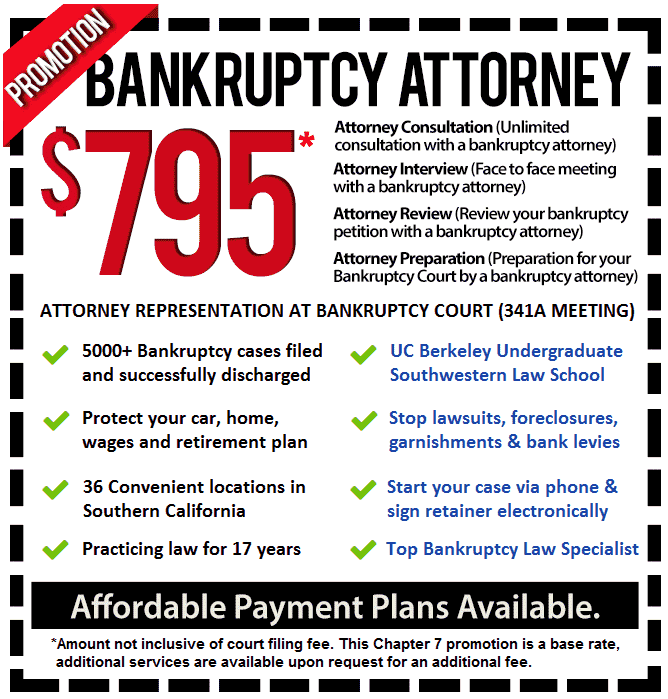

Bankruptcy is a legal process that provides relief to individuals or businesses that are unable to repay their debts. It is designed to help debtors start anew while ensuring that creditors receive some form of compensation. There are different types of bankruptcy, with Chapter 7 and Chapter 13 being the most common for individuals. After filing for bankruptcy, many people believe that they will never be able to obtain credit again. However, this is a misconception.

Rebuilding Your Credit After Bankruptcy

After bankruptcy, your credit score will likely take a hit, but it is not the end of the road. In fact, many lenders are willing to offer **loans after bankruptcy** to help individuals rebuild their credit. The key to successfully obtaining these loans is to demonstrate financial responsibility. This can be achieved by making timely payments on any remaining debts, maintaining a stable income, and gradually increasing your savings.

Types of Loans Available

There are several types of **loans after bankruptcy** that you may consider:

1. **Secured Loans**: These loans require collateral, such as a car or savings account. Because they are backed by an asset, lenders may be more willing to approve you despite your bankruptcy history.

2. **Unsecured Loans**: While more difficult to obtain, some lenders specialize in providing unsecured loans to individuals with a bankruptcy on their record. These loans typically come with higher interest rates due to the increased risk for the lender.

3. **Credit Cards**: Secured credit cards can be a great way to start rebuilding your credit. You deposit a certain amount of money, which serves as your credit limit. Responsible use of a secured credit card can help improve your credit score over time.

4. **Personal Loans**: Some financial institutions offer personal loans specifically designed for those who have filed for bankruptcy. These loans often come with higher interest rates but can be a useful tool for rebuilding credit.

Tips for Securing Loans After Bankruptcy

1. **Research Lenders**: Not all lenders are willing to work with individuals who have a bankruptcy on their record. Look for lenders that specialize in high-risk loans or those that advertise themselves as bankruptcy-friendly.

2. **Check Your Credit Report**: Ensure that your credit report is accurate after your bankruptcy discharge. Errors can further damage your credit score and make it more difficult to secure loans.

3. **Prepare Documentation**: Lenders will want to see proof of your income, employment stability, and any assets you may have. Having this information readily available can streamline the application process.

4. **Consider a Co-Signer**: If possible, having a co-signer with good credit can improve your chances of being approved for a loan.

5. **Be Patient**: Rebuilding your credit takes time. Even if you are denied initially, continue to work on your financial habits and consider reapplying in the future.

In conclusion, while **loans after bankruptcy** may seem difficult to obtain, they are not impossible. By understanding the types of loans available, taking steps to rebuild your credit, and being proactive in your search for lenders, you can successfully navigate your financial recovery. Remember, bankruptcy is not the end of your financial journey; it can be the beginning of a new chapter filled with opportunities for growth and stability.